How to Short Amazon Stock in 2022

Jan 21, 2024 By Triston Martin

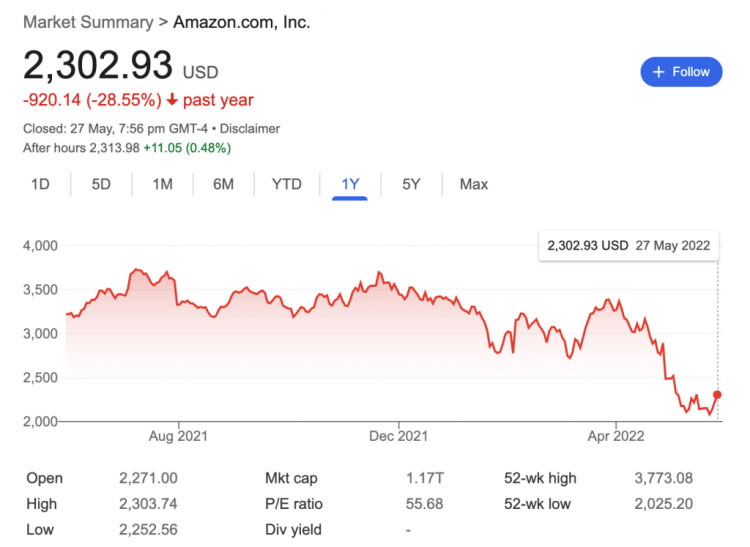

Amazon.com Inc. (AMZN) seems to be a stock that draws die-hard believers and doubters owing to its competitive e-commerce business plan. The corporation has foregone earnings in favor of obtaining market share. Amazon continues to pursue this course of action despite the fact that it has been in existence for more than 20 years when it is far more typical of early-stage enterprises. The stock price of Amazon has been on an upward trajectory for most of its history as the company has attracted investors that share the vision of its founder, Jeff Bezos.

Shorting Amazon

For those who do not think that Amazon can start translating its market dominance into profitability, there are a lot of strategies to short the company. Amazon's stock would undoubtedly plunge if investors lose trust in the company's ability to keep expanding its market share via the introduction of new products or if, at some time, this market share will result in profits. High-multiple momentum equities that fail to match investors' expectations may yield large gains for short-sellers.

Shorting shares of Amazon's stock via a broker is the quickest and easiest method to make money off of a drop in the company's share price. When shorting a stock via a broker, you will first borrow the stock, and then you will either sell this at the market or place a limit order to sell it. Eventually, the stock must be repurchased to complete the deal. If the stock is repurchased at a higher price than when it was sold short, the investor will have lost money. The short-seller makes money when the stock's price drops and is then purchased back at a lower price.

Amazon Stock Investment Options

Direct Shares Purchase Plan (DSPP) is your best option if you want to purchase Amazon stock directly. Amazon's Direct Shares Purchase Plan, or DSPP, was introduced in 2019 and allowed you to invest directly in Amazon's stock without the need for a broker. You may do this by creating a Computershare account.

Investing in Amazon shares via a mutual fund is another option. Mutual funds that focus on technology businesses are a good option if you want to increase your Amazon holdings. You'll also be able to benefit from a broader portfolio of equities if you do this. Investing in a fund rather than a single firm is the safest alternative since your profit isn't dependent on just one company. Even if Amazon's stock price falls, your investment may still be a success. Human or robot-driven financial counselors may also be consulted. Diversifying your portfolio with these may help you learn more about how, when, as well as for how long to invest in certain stocks.

Risks Involved

Shorting a stock, on the other hand, comes with a hefty price tag in terms of the potential loss. Borrowers are charged a monthly fee for each loan they take out. In the case of Amazon, this cost is low, but it may go up if there's a lot of short-selling activity. The mechanics of short selling are stacked against the short-seller, which is another risk associated with short selling. For a long position, an investor might lose 100% of their money on a single stock. Losses are theoretically limitless when shorting. Short sellers may earn a profit of 100% if the stock price falls to zero. As a result, short-selling is only suitable for experienced traders who are aware of the dangers.

Shorting a stock carries the additional risk of a short squeeze. If the stock price or the company shows signs of deterioration, then short sellers will be drawn to high-value stocks like Amazon. Bullish catalysts have the potential to lead to large gains, but this also carries risk. As shorts are compelled to cover to prevent losses or as a result of risk management, the profits might become inflated. Shorts covering, of course, leads to an increase in demand, driving the price even higher. Because of this, short sellers must have a strategy in place for counter-trend rallies as well as short squeezes. Examining a stock's short float might help assess the likelihood of a short squeeze.

Conclusion

Since its inception as a small online bookstore, Amazon has grown into a multi-billion-dollar international corporation. In February 2021, it had a market value of $1.58 trillion. The company's revenue for the fiscal year 2020 was $386 billion. Such numbers have driven investors to Amazon, where they can buy some of the most expensive stocks. Now that you understand how to purchase Amazon stock, you may join them and become one of them.

Banking

Callable CDs: A Deep Dive Into This Unique Investment Option

Callable CDs offer higher interest rates but come with potential risks. Explore how they work, their pros and cons, and see if they fit your financial strategy in 2024.

Learn More

Investment

The Cboe Volatility Index (VIX)?: What You Need To Know

Investors have used the Cboe Volatility Index, abbreviated VIX, to gauge the degree of risk, worry, or stress throughout the market whenever making investment choices. Traders may trade the VIX using a wide range of options and marketplace products or use VIX values when pricing derivatives.

Learn More

Investment

How to Short Amazon Stock in 2022

Amazon still prioritizes revenue and market share growth above profitability in its growth plan. To take advantage of what is anticipated to be a decrease in the price of Amazon's shares, investors who are keen on shorting the stock should do so using the services of a broker. This is the simplest method to do so. The second alternative is to purchase puts on the stock. The biggest dangers connected with shorting the company, especially Amazon, are the borrowing costs and the possibility of endless losses.

Learn More

Know-how

Progressive Auto Insurance Reviews

1937 was the year when Progressive Mutual Insurance Company first started selling auto insurance. Today, in addition to providing insurance for drivers, Progressive also provides insurance for homes and other properties, businesses, and a wide variety of personal insurance options, including plans for life, pets, and travel.

Learn More

Know-how

The 7 Golden Rules for Having More Money for Your Golden Years

Explore the top strategies for enhancing your retirement savings, including starting early, diversifying investments, and cutting costs.

Learn More

Investment

Stock Delisting vs. Stock Suspension: Key Differences Explained

Discover the key distinctions between stock delisting and stock suspension, how they can impact a company's stock market status, and the reasons.

Learn More