Top 5 Most Important Points To Remember Before Rolling Over Your IRA

Dec 17, 2023 By Susan Kelly

There are several advantages to transferring retirement funds from a previous employer's retirement to a self-directed individual retirement account (IRA), such as making non-traditional investments. Almost two-thirds of all households with IRAs have rolled over funds into their IRAs. 1 However, the most common reason for transferring funds from a 401(k) to an IRA is because the account holder does not wish to leave their retirement funds in the hands of their previous employer. 1 Don't risk your retirement savings by abruptly severing relations with your former employer, whatever you think about them. Knowing the tax implications of rollovers and what you should avoid doing might help you protect and increase your retirement nest egg. What you may and cannot do with these IRA rollovers and transfers is outlined below.

5 Most Important Points to Remember Before Rolling Over Your IRA

Pay Your Taxes Late or Early

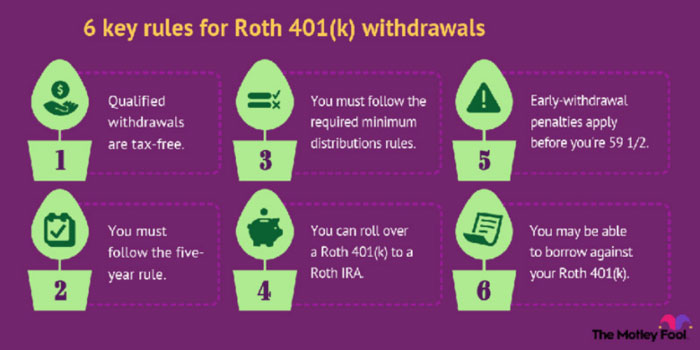

You can put up to $6,000 in a traditional IRA if you're 50 or older and delay paying taxes on that money until you withdraw it in retirement. The principal and the interest accrued in an individual's savings account are subject to ordinary income taxation upon withdrawal. Contributions to a Roth IRA are made using after-tax monies, and earnings and withdrawals made through accounts that are less than a minimum of five years old are not subject to taxation. Putting money into both retirement plans can provide you with more options and reduce your tax burden.

Later Deadline for Contributions

If your workplace offers a retirement plan, you likely need to get your contributions in by December 31. However, if you're contributing to an individual retirement account (IRA), you can't wait to make deposits until the day you file your taxes. Specifying the tax year when contributing funds toward an IRA between January 1 and even the tax deadline is important. You can claim a conventional IRA deduction on your federal tax return even if you haven't made the deposit yet, but the money needs to arrive in the account by both deadlines.

The Majority of Ira Funds Are Rolled Over

The Employee Welfare Research Institute found that in 2008, rollovers accounted for $732.9 billion, or more than 10 times as much as contributing directly to IRAs, which totaled $14.1 million. A person can add up to $5,000 but rather $6,000 per year to an IRA based on age. And there is no cap on the amount to be rolled over into an IRA from just a 401(k) and another such retirement plan upon changing jobs or retiring. In 2008, the typical rollover was $74,785, compared to an individual's regular contribution of $3,666.

Retirement Withdrawals at an Older Age

Withdrawals from a 401(k) plan are not subject to a penalty for workers who quit their roles at age 55 or later (and perhaps approximately 50 among public safety employees). To avoid paying taxes on the money if it's rolled into an IRA after retirement, the recipient must be at least 59 1/2 years old. According to David Hultstrom, CFP, president of firm Financial Architects throughout Woodstock, Georgia, "unless someone is 56 and retiring, then should roll from over component of the 401(k) those who are not intending to foreseeably demand in the coming years," while leaving in the 401(k) what they need shortly.

Free Early Withdrawals

Several loopholes can be used to avoid the 10% tax assessed on withdrawals made before age 59 and 12. Withdrawals made before age 59 1/2 are subject to a 10% penalty unless the money is used to pay for insurance when losing a job, becoming disabled, or being called up from military reserve status. There are no fees if you use the money for a down payment on a property or tuition at an accredited university upwards of $10,000 ($20,000 for married couples).

Conclusion

Nearly $28 trillion, or approximately a quarter including all retirement assets, was held in individual retirement accounts in 2010. In 2016, nearly half of all American adults held some of their savings in an individual retirement account (IRA). The financial security you can enjoy in retirement depends on your ability to make wise investment decisions with your IRA and minimize tax consequences through its use. Here are ten tips if you're wondering what to do with your individual retirement account. Retirement funds can be transferred between individual retirement accounts (IRAs) and employer-sponsored retirement plans (like 401(k)s), as is often known.

FinTech

State Farm Bank 2024 Review: What Customers Should Know

State Farm US Bank has provided banking services, loans, and credit cards in the past. People who desire banking and insurance under one roof will find the bank handy.

Learn More

Know-how

How Much Does it Cost to Live in a Nursing Home

Many elderly people require the special care that nursing homes provide. However, before deciding on a nursing home, it is crucial to grasp the true cost of such facilities. In this article, we'll look at some causes of nursing home expenses and solutions to that problem. You can use this data to decide better how to care for your loved one

Learn More

Know-how

Exploring Fiscal Drag: Impacts and Implications in Economics

Learn what fiscal drag is and how it impacts the economy. Discover the causes of fiscal drag and its effects on businesses. Stay informed about this economic concept.

Learn More

Investment

The Cboe Volatility Index (VIX)?: What You Need To Know

Investors have used the Cboe Volatility Index, abbreviated VIX, to gauge the degree of risk, worry, or stress throughout the market whenever making investment choices. Traders may trade the VIX using a wide range of options and marketplace products or use VIX values when pricing derivatives.

Learn More

Investment

Tips for Investing Substantial Sums

Cash savings accounts are popular among those who want to save a large sum of money all at once and collect interest on it over a long period of time. You may save more money this way without taking on as much danger. Banks may offer income on savings accounts since they are considered safer than checking accounts.

Learn More

FinTech

Epic Systems Introduces 100+ AI Features for Healthcare Innovation

With more than 100 new AI features, Epic Systems is improving healthcare by increasing productivity for physicians and patients.

Learn More